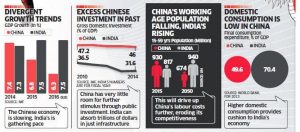

Surveys and reports all over the world predict that by 2030, India could be the rising economic powerhouse of the world as China is seen today. As the world’s largest economic power, China is expected to remain ahead of India, but the gap could begin to close by 2030. Various reports suggest that India’s rate of economic growth is likely to rise while China’s would slow. According to one report, the total size of the Chinese working-age population will peak in 2016 and would decline then onwards. In contrast, India’s working-age population is unlikely to peak until about 2050.

According to one National Intelligence Council (NIC) USA report,

“India’s expected robust growth in the next 15-20 years means that its contribution to global growth will surpass that of any individual advanced economy except the United States,”

To maintain this momentum, the Government is putting lot of emphasis on developing entrepreneurship and expansion of manufacturing industry by introducing schemes like ‘Make in India’ (encouraging multi-national, as well as national companies to manufacture their products in India), ‘Startup India’ (promoting bank financing for start-up ventures to boost entrepreneurship and encourage startups with jobs creation) and creating infrastructure for taking ‘Digital India’ to an advance level.

Presently many developed countries all over the world like the US, UK, France, Germany, Japan, South Korea etc. want to expand their business operations in India to the highest level. China also is pumping huge investments for the creation of industrial parks in India for promoting manufacturing here. All these are new efforts by the international community to bring more development and an enhanced relationship with resurgent India. Thanks to the above-mentioned developments and government steps, India has already become the highest-attracting Foreign Direct Investment (FDI) destination worldwide in 2016, ensuring capital investments in six new industrial corridors and 100 smart cities being planned around these corridors.

India’s population is around 126 crore (increasing every year by 1.2%), the current Gross Domestic Product (GDP) valuation is $2 trillion (increasing currently by 8% annually) and the GDP Purchasing-Power-Parity (PPP) is around $ 8.6 trillion (making it the third-largest economy in the world by this criteria). Analysis of all these indicators points to good times ahead for Indian Economy and thereby Tax Revenue Collection.

A huge population is both boon and bane for any country but for a country like India it is mostly a boon for the business community because of the opportunities it entails as the buying capacity of this population is huge. Though the balance of trade is in deficit currently by approx. $ 8100 million, meaning imports are more than exports which further imply that new manufacturing thrust could easily tap export markets. Balance of trade can be balanced smoothly in the near future as the crude rate is settling at a comfortable level of around $ 50. Also with the opening of FDI in defence and other crucial areas, development in India would lead to an unimaginable growth which can be sustained for many decades provided our government and other political parties work as a community (team) for development of India as a modern nation.

One area, however, which comes out like a sore thumb and needs corrective measures, is our tourism Industry. Despite India being one of the oldest civilisations and home to so many heritage sites, our share in international tourism is minuscule (5.29 lakh tourists per annum which is less than 2% in world tourism). But it can be turned into a big opportunity by creating a robust infrastructure and ensuring an efficient law and order system pan-India. Tourism could become the next big industry in resurgent India like what happened in information technology and pharmaceutical industries in the 90s.

India also needs to take note on tax concessions provided by other countries which are in violation of rules framed by the World Trade Organisation (WTO). Exporting nations take direct tax measures which provide protection against imports and facilitates their exports. The whole object of the WTO is to ensure that there is no barrier to cross-border flow of business and to achieve more efficient resources. However, some countries provide undue tax benefits and India cannot compete with those countries in the absence of similar tax concessions.

India has embarked on a path to set up a tax system where the scope of tax litigation for businesses is very less. A more transparent tax system will add much more strength at this juncture.

Another noteworthy point is that different states in India are also getting actively involved in creating infrastructure and attracting investment & business in their respective states. Many state governments like Gujarat, Uttar Pradesh, Himachal Pradesh, Andhra Pradesh, Tamil Nadu are actively scouting for investment and trying various methods to impress businesses.

The recent example where all political parties got together and passed a Constitution amendment for the GST Bill in the Upper House of Parliament proves that even political parties understand the need of the hour is to create a more powerful and developed India.

If all goes well, Indian Elephant is on its way to becoming a Mammoth!